Forecasting Algorithm “Holy Grail” for Stock Market

February 3, 2023

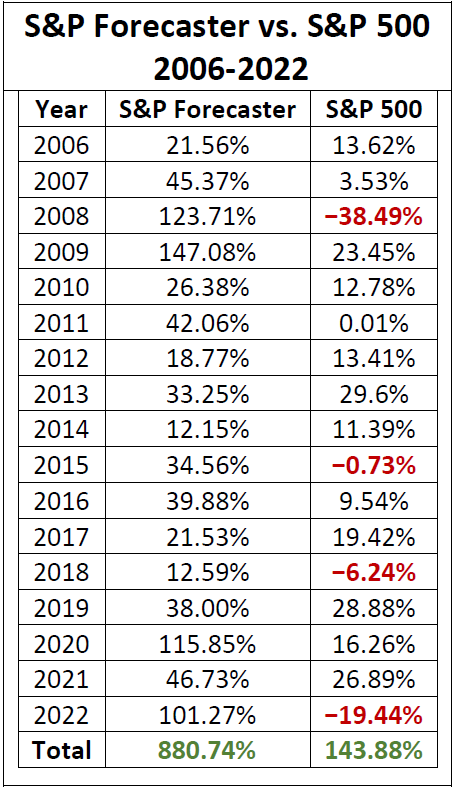

S&P Forecaster, an algorithm that is the stock market’s “Holy Grail” generated 880.74% (51.8% per annum) vs. the S&P 500’s buy and hold gain of 143.88% (8.5% per annum) from 2006 to 2022. S&P Forecaster also forecasts crashes and has forecasted a significant market crash for 2023. Dynasty Wealth (DW) is in the process of integrating the algorithm’s signals into its hedge funds.

The table below depicts that the algorithm generated a profit from trading the S&P 500 long and short for every year from 2006–2022.

During this period, the S&P Forecaster also outperformed the S&P 500 every year.

The S&P Forecaster Algorithm is the Holy Grail, Because, …

It is the Only Algorithm that Forecasts Dates for the S&P 500’s Highs and Lows

A Year in Advance!

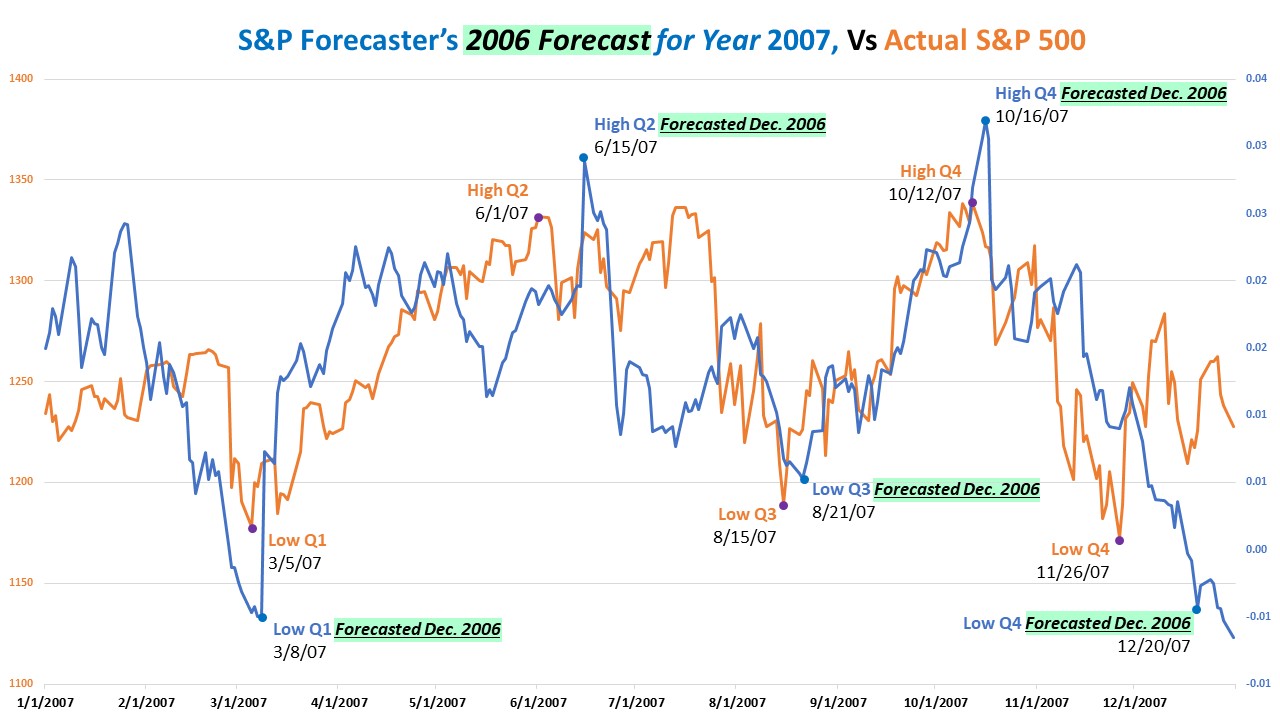

The chart below contains the 2006 forecast for 2007

The year 2007 was selected as an illustration because it was among the S&P 500’s least volatile: Thus, ideal for displaying the orange line overlay of the S&P 500’s actual high and low dates in the chart below.

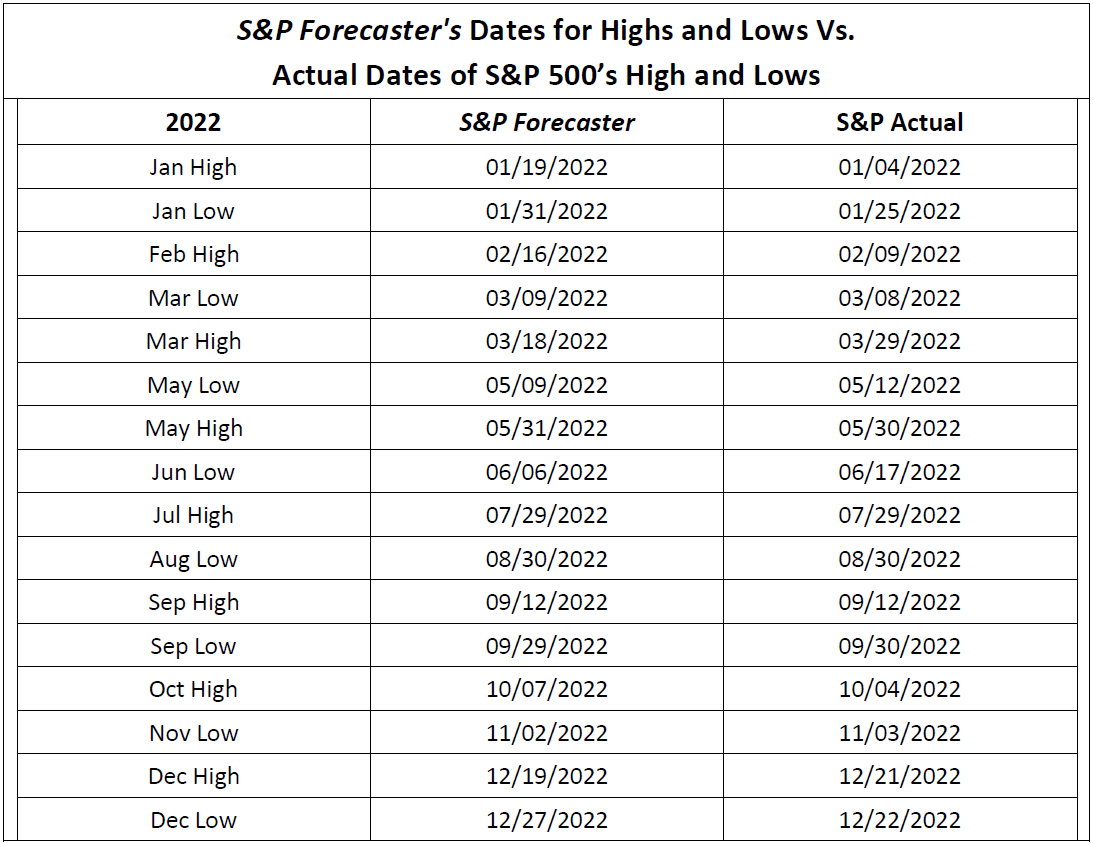

The table below compares the algorithm’s December 2021 forecast for the year of 2022, vs. the S&P 500’s actual performance for 2022.

For all of the algorithm’s forecasts for high and low dates ― compared to the S&P 500’s actual high and low dates ― from 2006 to 2022 click here.

The table below depicts the performance of DW’s Bull & Bear Tracker (BBT), S&P 500 and S&P Forecaster from 2019 to 2022. S&P Forecaster’s gains were 2.5 times the BBT and 6.0 times the S&P 500 from 2019 to 2022.

Dynasty Wealth’s legal counsel is presently drafting a Joint Venture Agreement (JVA) between DW and the developer. The developer has also agreed to transfer ownership of a British Virgin Islands (BVI) offshore hedge fund to DW. Under the JVA, the algorithm is to be exclusively utilized to power DW’s two U.S. hedge funds and the BVI hedge fund.

S&P Forecaster is forecasting a significant crash for 2023. The crash has the potential to become as infamous as the crashes of:

- 1929 crash which coincided with the 1929–1938 Great Depression

- 2008 crash which coincided with the 2008 Great Recession

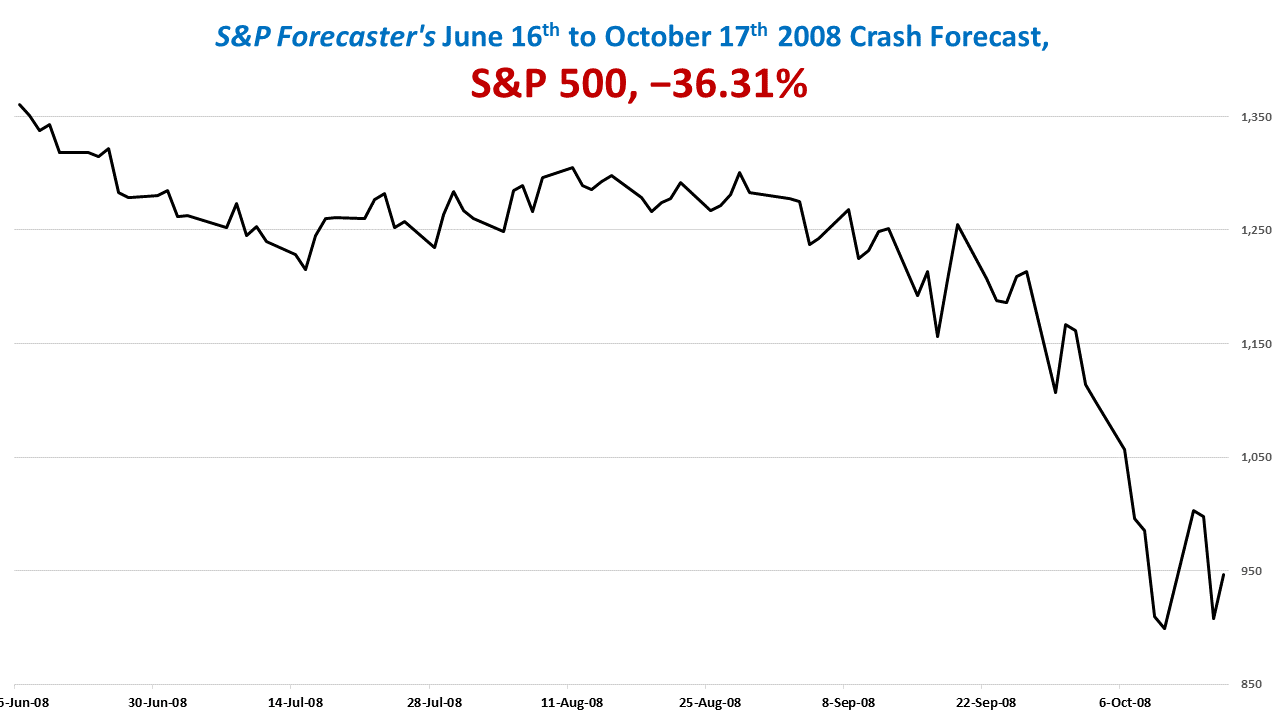

The chart below depicts the S&P 500’s crash, a 36.31% decline, for the S&P 500 from June 16, 2008 to October 17, 2008. The dates for the high and low were forecasted by S&P Forecaster in 2007.

According to S&P Forecaster’s 2023 forecast, the S&P 500 will reach its 2023 high for the year before it declines to below its 2022 low. The path for the new low will be a very steep crash, similar to the June 2008 through October 2008 decline, which was forecasted by S&P Forecaster in the above chart.

The S&P Forecaster is needed by every investor, for reasons that follow:

- Accuracy at forecasting the dates of the S&P 500’s future highs and lows increases gains from buying at the low and selling at the high.

- Provides higher after-tax gains, more liquidity and less risk than buying and holding S&P 500 Exchange Traded Funds (ETFs).

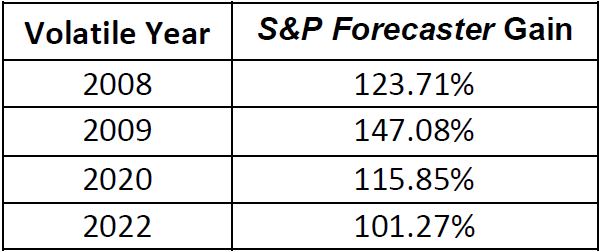

- Produces gains in excess of 100% during the index’s most volatile periods. (See table below)

With S&P Forecaster’s 2023 forecast, hedge funds with exclusive access to its signals have the high probability of producing gains of more than 100% for 2023, and also for 2024. (The gains for crash-year 2008 and the post-crash 2009 recovery year were 123.71% and 147.08%, respectively.)

Dynasty Wealth’s crash expert Michael Markowski’s prediction for the 3rd Great U.S. Depression to begin in 2023 coincides with the 2023 crash that has been forecasted by S&P Forecaster. According to Michael this crash forecast is significant, because a crash is the primary catalyst to transform a recession into an economic depression.

The articles below contain Mr. Markowski’s research findings in support of his predictions for a significant decline of the S&P 500, and for the 3rd U.S. Great Depression to begin:

Related June 2022 articles:

September 2022, NYC “Entrenched Inflation” presentation videos:

Part 1: Crash During Recession to Cause 3rd Great Depression

Part 2: Return of Capital (ROC) Defensive Investing Strategy