How $6K could become $5.8 Million in a Year or less?

Direct link: https://dynastywealth.com/from-6000-to-up-to-5800000-in-a-year/

Published July 29, 2023. Updated on September 18, 2023.

Michael Markowski

Since joining Merrill Lynch upon my college graduation in 1977, I have been a student of the markets. My thirst to learn about the markets has resulted in many of my followers having an opportunity to invest $6,000 to make millions fairly quickly.

My career has been defined by conducting empirical research on the anomaly events for the stock market that I have witnessed. Finding the common denominators or the causes of the events led to my developing algorithms which are utilized to predict future events before they occur.

- Enron’s spectacular bankruptcy (2001) – resulted in development of an algorithm which was utilized in 2007 to predict the epic September 2008 collapses of the five largest U.S. brokers including Lehman Brothers. See “Have Wall Street’s Brokers been Pigging Out”, Equities Magazine September 2007.

- Bank of Japan announcement about negative interest rate policy (NIRP) caused a 7% decline of S&P 500 for the first seven days of February 2016. The result was my development of NIRP Crash Indicator algorithm which predicted June 2016 post Brexit vote crash. The algorithm also powers Bull & Bear Tracker’s long and short index trading signals. Bull & Bear Tracker gained 193% vs. 61% for S&P 500 from March 2018 through June 2023.

- S&P 500 declining by 12% six days after it reached its 2/19/20 all-time high resulted in development of SCPA algorithm. SCPA precisely predicted that S&P 500 would continue to decline until the index had declined by a minimum of 34% below its high. SCPA also predicted that the 34% decline would occur by end of March 2020. S&P 500’s 2020 low occurred on 3/23/20.

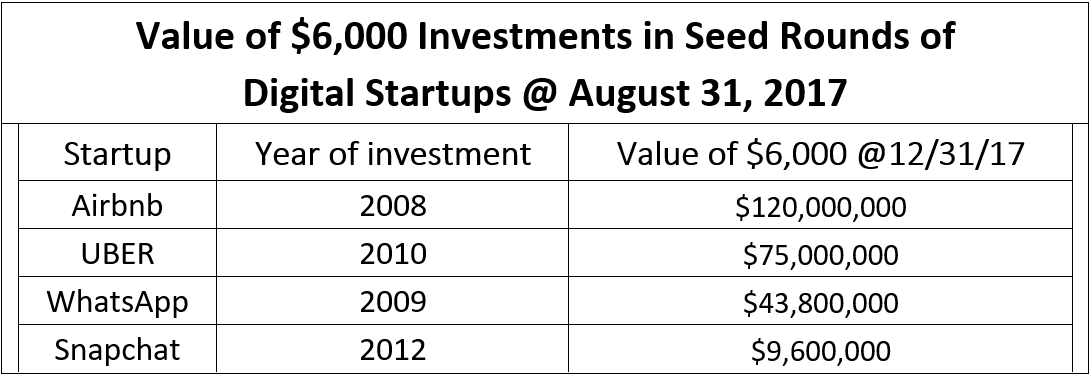

- Discovery that $6,000 investments in each of the four startups in the table below were valued for as much as $120 million in nine years or less resulted in developing a methodology to identify startup investing opportunities with similar potential.

The common denominator shared by all of the companies in the above table is that they have digital business models. Based on this revelation my research focused on the transformation of the global economy from agricultural in the late 19th century to industrial in the 20th century. The catalyst that caused the transformation to industrial was the completion of the transcontinental railroad in 1869. The transformation resulted in dynasty wealth being created for those who founded and funded the new industrial businesses in the late 19th and early 20th centuries. View video below.

The transformation of the global economy from industrial to digital began when the internet or world wide web was invented in 1989. The event which created dynasty wealth for the shareholders of the digital companies in the above table from 2008 to 2017 was the internet reaching a critical mass of one billion users in 2009.

Due to my research of the two economy transformations since 1869 Dynasty Wealth was founded. The mission of Dynasty Wealth the is to identify and to assist digital and other startups with the potential to increase by 1,000 times in value and to reach $1 billion valuations within 10 years.

EmotionTrac (former name Jinglz) was a startup when it was identified by Dynasty Wealth in 2016 after it won Florida Atlantic University’s best business plan contest. Since launching its first product EmotionTrac’s revenue has increased for the last three consecutive calendar years. For the 12 months ended June 30, 2023 revenue increased by 163.7%.

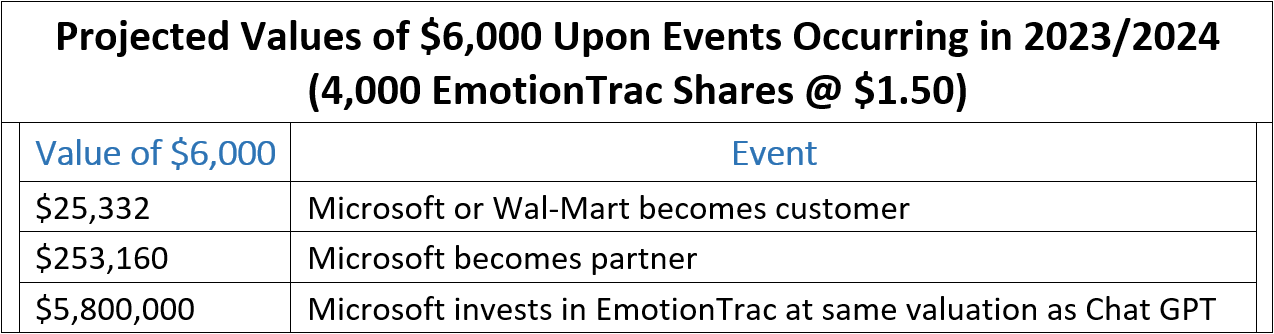

The table below contains the projected value of $6,000 upon certain events occurring in 2023 or 2024.

Dynasty Wealth’s members have participated in all of EmotionTrac’s funding rounds. Those who invested $6,000 in EmotionTrac’s seed round at $0.50 per share could potentially have their investment valued for $17,400,000 assuming the best case scenario in the above table.

Anyone who views the video clip updates below will agree that the probability is high for each of the events in the above table to occur. Since June 2023 EmotionTrac has been in discussions with the leaders of three of Microsoft’s divisions. Each of the Microsoft divisions need EmotionTrac’s patented software and digital ad testing solution. Most significantly the integration of EmotionTrac’s system into Chat GPT will enable the growth rate of Microsoft’s AI products to accelerate.

The company is presently raising capital from accredited investors at $1.50 per common share. EmotionTrac intends to close the $1.50 per share round upon the maximum amount that is remaining at the $1.50 price being subscribed. The maximum amount of shares available per investor is 4,000 shares or $6,000. Since there is a limit to the total number of shares available at $1.50 orders will be filled on a first come first serve basis.

Upon the $1.50 price round closing a new round will open and also be available in limited quantities per investor at $2.00 per share. Upon the $2.00 round closing another round will open at $3.00 per share and will also be available in limited quantities per investor. The $2.00 and $3.00 rounds will be offered and available to any investor (accredited and non-accredited) via a crowdfunding portal.

EmotionTrac, Inc

Founded: 2016

Projected to be unicorn: 2024

Proprietary human emotions analyses software which addresses the markets below that represent $1 trillion in aggregate:

- TV commercials

- Legal/Mock Jury

- Films (movies & TV series)

- Market Research

- Retailer Media Network

- SME marketing services

Patents issued to EmotionTrac, Inc (formerly Jinglz, Inc.)

Industries disrupted by EmotionTrac:

- Market research $83.9 Billion

- Focus groups, $2.7 Billion

Videos about EmotionTrac & why it is well positioned to increase to a billion-dollar valuation quickly:

- EmotionTrac & AI Industry, 10 minutes, 32 seconds, 6/24/23

- Digital disruptor companies have the potential to get $10 billion valuations quickly, 4 minutes, 1 second, 5/15/16

The table below contains clips from the videos that were produced from the June 24, 2023 to August 26, 2023, “Markowski on the Market” weekly sessions. The videos explain:

- Retail Media Advertising (RMA)

- The rationale for why Microsoft needs EmotionTrac to:

─dominate RMA

─enable ChatGPT/Bing to better compete against Google Search

EmotionTrac Revenue & % change vs. prior year

| Year | Revenue | % Change |

| 2020 | $7,258.99 | N/A |

| 2021 | $99,001.98 | 1364% |

| 2022 | $243,313.57 | 246% |

| 2023 EST* | $600,000 | 247% |

*@12/31/2022

Financial Statements available at SEC website:

https://www.sec.gov/Archives/edgar/data/1721305/000149315223033197/formc-ara.htm

Financial Statement Summary @ 6/30/2023

Revenue for 12 months ended 6/30/23: +163.7%

Gross Profit Margin on aggregate revenue since inception: 88.2%

Paid in capital: $5,877,926

Shares outstanding: 15,831,849

Market cap: $23,747,233

Capital raised via accredited investor private placements and two crowd fundings:

- $849,247 @$1.00 per share March 2018, StartEngine

- $248,588 @ $1.50 per share April 2021, NetCapital

Complete Financial Statements for 2017-2022 available via SEC.gov.

To be alerted when an opportunity becomes available to invest in EmotionTrac fill out the form below.

Dynasty Wealth LLC receives cash, shares and options to purchase shares for providing consulting services to EmotionTrac. For terms and conditions see Financial Relations Agreement.